how to check my unemployment tax refund online

If none leave blank. Download the IRS2Go app.

The Irs Is Making Deposits For Unemployment Tax Overpayments Wfmynews2 Com

Unemployment Refund Tracker Unemployment Insurance TaxUni.

. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide. The first10200 in benefit. How do I check on my unemployment tax refund.

If you see a 0. Viewing your IRS account. Numbers in Mailing Address Up to 6 numbers.

Check your refund status make a payment get free tax help and more. If you havent opened an account with the IRS this will take some time as youll have to take multiple. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

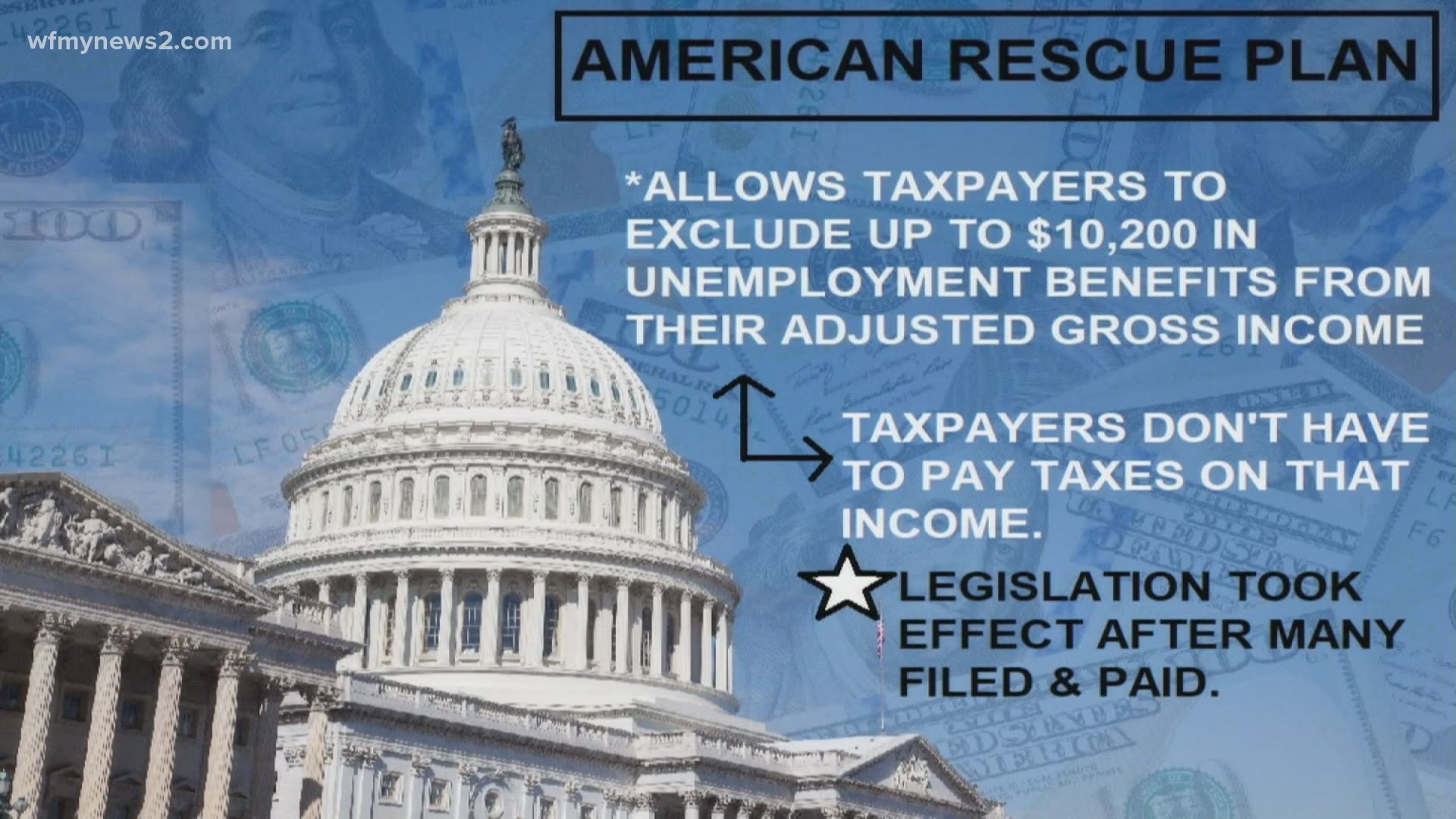

If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. The easiest way to do this is by figuring out your taxable income by not adding the unemployment compensation exclusion youre eligible for and then tax liability. If you received unemployment benefits last yearyou may be eligible for a refund from the IRS.

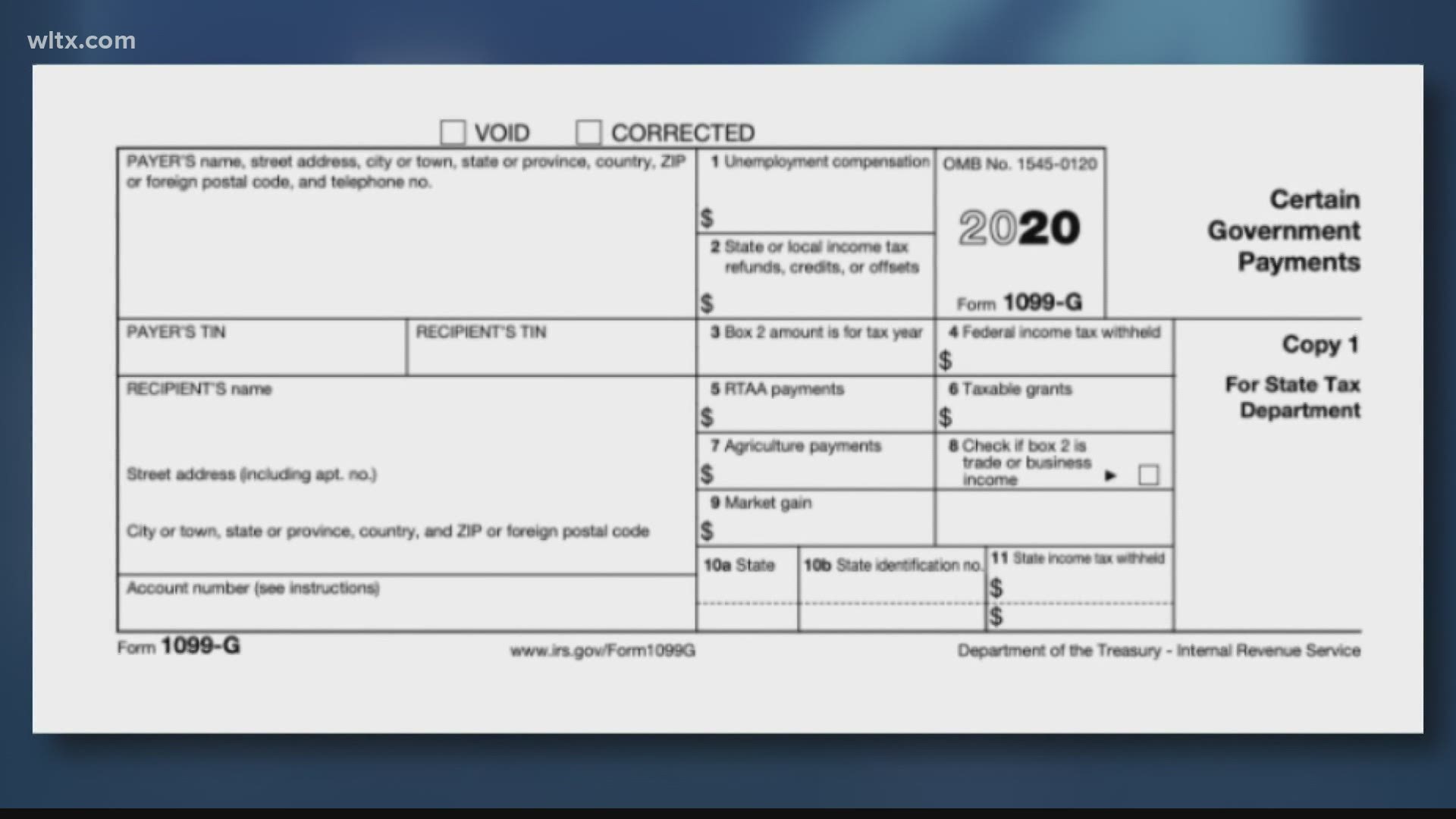

Check Your 2021 Refund Status. Your exact refund amount. Form 1099G tax information is available for up to five years through UI Online.

Go to slide 2. This is the fastest and easiest way to track. If an adjustment was made to your Form 1099G it will not be available online.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Visit IRSgov and log in to your account. How long it normally takes to receive a refund.

Is IRS still sending out unemployment refunds. Check your refund online does not require a login Sign up for Georgia Tax Center GTC account. IRS sending unemployment tax refund checks Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

Ways to check your status. Heres how to check online. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

Go to slide 3. Social Security Number 9 numbers no dashes. Numbers in your mailing address.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Using the IRS Wheres My Refund tool. If your mailing address is 1234 Main Street the numbers are 1234.

The IRS has sent 87 million unemployment. Go to slide 1. GTC provides online access and can send notifications.

/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

Trace Your Tax Refund Status Online With Irs Gov

Confused About Unemployment Tax Refund Question In Comments R Irs

Millions Still In Line For Unemployment Tax Refunds

Irs Unemployment Tax Refund Timeline For September Checks

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Tax Extension Deadline And South Carolina Filing Tips Wltx Com

How To Claim Unemployment Benefits H R Block

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube

Is Unemployment Taxed H R Block

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

When Will Unemployment Tax Refunds Be Issued King5 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back